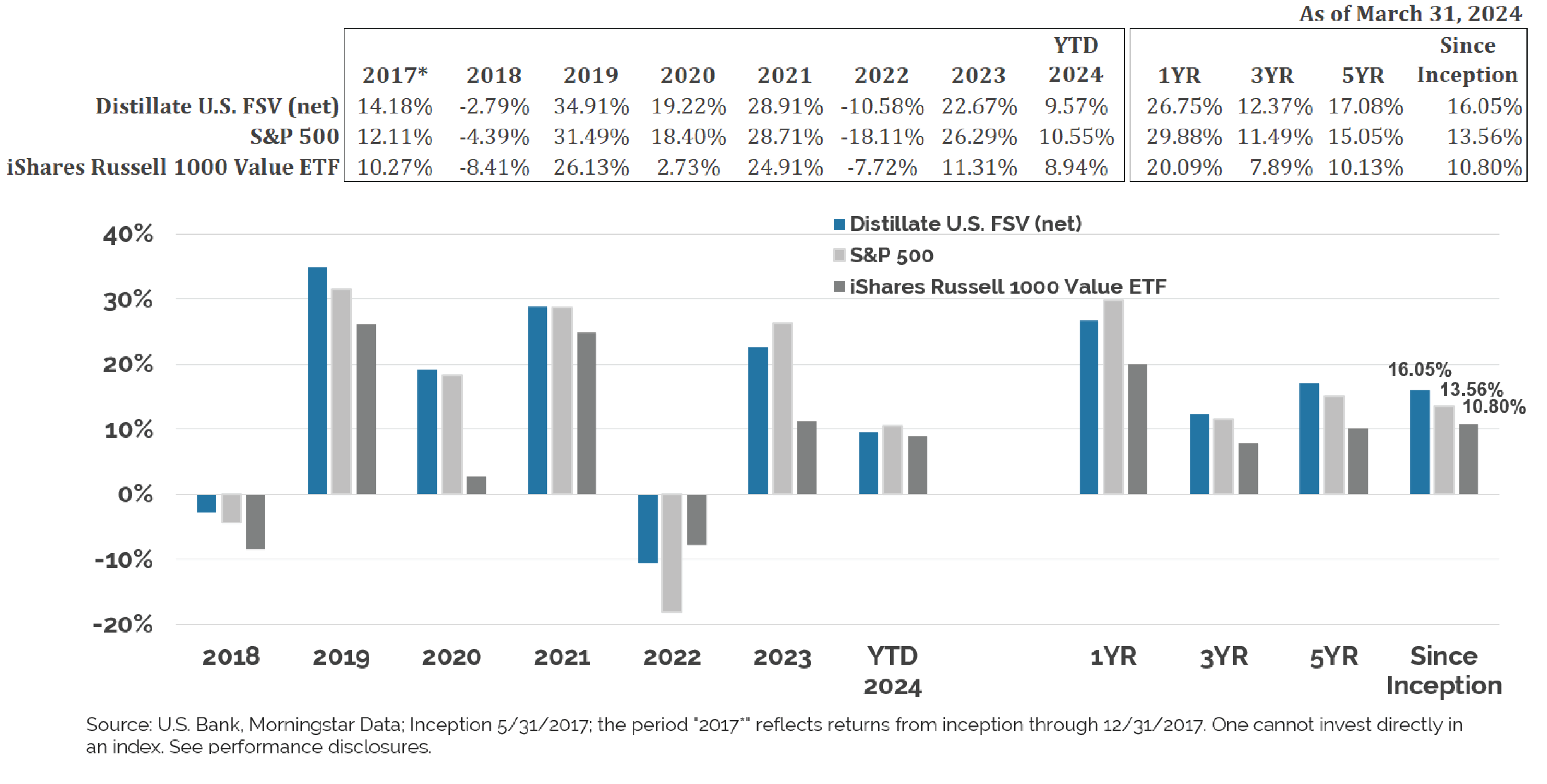

Strategy Performance

Investing involves risks and you may incur a profit or a loss. Past performance is no guarantee of future results.

* 2017 performance represents the period from 5/31/17 (inception) to 12/31/2017.

** Since inception performance represents the period from 5/31/17 (inception) to present (the date noted on the chart or table).

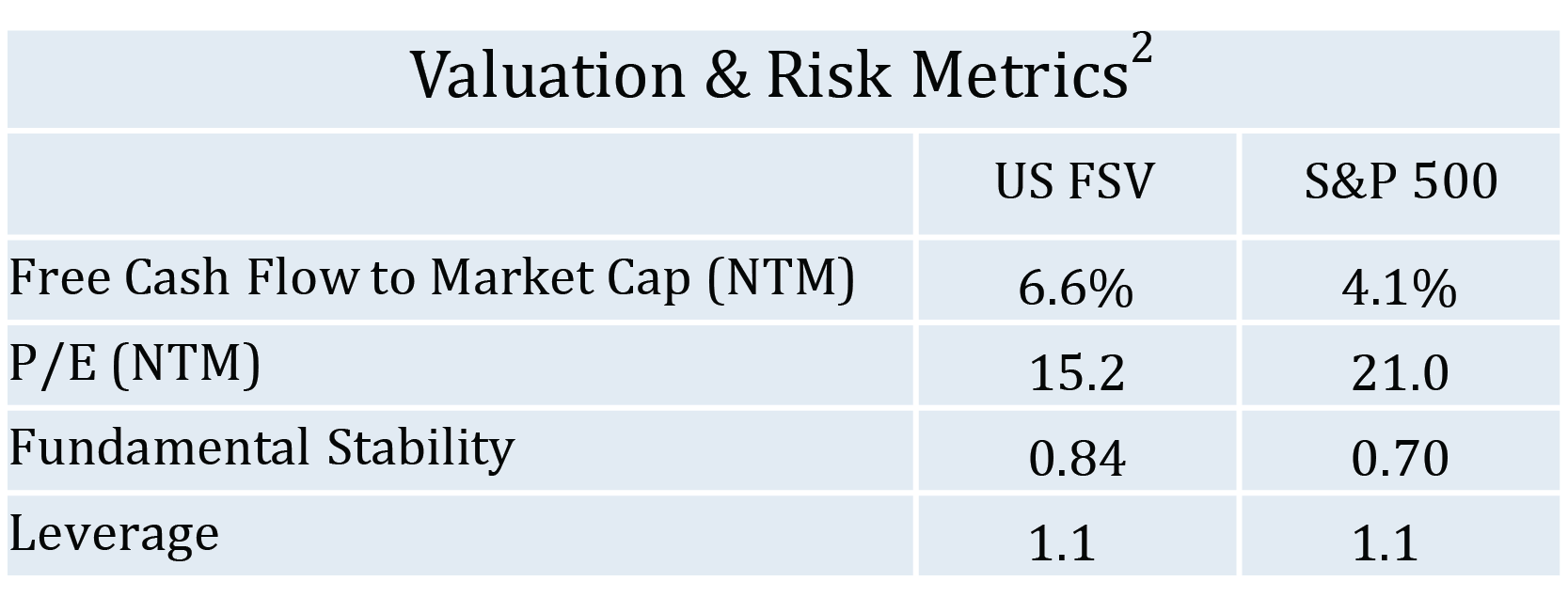

Portfolio Characteristics

Free Cash Flow to Market Cap reflects next-twelve-month consensus (FactSet) free cash flow estimates divided by market capitalization, excluding those stocks >50% and <-20%. P/E is a measure of per share market value compared to next-twelve-month consensus (FactSet) EPS estimates. It excludes PE ratios less than 0 or greater than 250. Fundamental Stability is a measure of cash flow stability over time, calculated as a regression statistic of operating cash flow per share against time, and looking back multiple years with actual reported data, and forward multiple years using estimated data (FactSet). Leverage is a measure of a company’s Adjusted Net Debt divided by the average of its estimated FY1 and FY2 Earnings Before Interest Taxes Depreciation & Amortization (FactSet).

Data for US FSV reflects the constituents of a representative composite account.

Disclosures

Distillate Capital Partners, LLC (“Distillate”), is an investment adviser registered with the United States Securities and Exchange Commission in accordance with the Investment Advisers Act of 1940. Registration as an investment advisor does not imply a certain level of skill or training. Distillate claims compliance with the Global Investment Performance Standards (GIPS®). GIPS® is a registered trademark of CFA Institute. CFA Institute does not endorse or promote this organization, nor does it warrant the accuracy or quality of the content contained herein. To receive a GIPS Report and/or our firm’s list of composite descriptions please email your request to info@distillatecapital.com. A copy of our U.S. FSV GIPS Report can be downloaded HERE.

Returns are presented net of management fees and include the reinvestment of all income. Net of fee performance was calculated using an annual management fee rate of 0.39% applied 1/12th monthly, which is the highest investment management fee that may be charged for this composite. Policies for valuing portfolios, calculating performance, and preparing GIPS Reports are available upon request.

The S&P 500 Index and iShares Russell 1000 Value ETF are presented as benchmarks for US FSV, the latter representing the Russell 1000 Value Index. The S&P 500 Index is a market-capitalization-weighted index of the 500 largest U.S. publicly traded companies. The iShares Russell 1000 Value ETF tracks the investment results of large- and mid-capitalization U.S. equities that exhibit value characteristics. Returns for the iShares Russell 1000 Value ETF are calculated using the net asset value of the fund, which may vary somewhat from the results of the reference index.