2024 1Q Letter to Investors: The Magnificent 1?

While NVIDIA has driven the market’s valuations higher, we continue to find valuation opportunities that meet our quality standards, leading our U.S. FSV portfolio to its widest free cash flow yield premium in its history. Our Small/Mid QV and International FSV portfolios likewise offer very attractive combinations of valuation and quality.

Are Small Stocks Really Cheap? It Depends

This one pager examined whether small cap stocks are as cheap as is often touted. The high percentage of unprofitable companies is significantly distorting traditional PE calculations for the small cap indexes, but in our estimation there are many excellent values to be had in this segment of the market by being selective using free cash flow-based measures of valuation.

2023 Year-End Letter to Investors

The U.S. equity market’s performance was dominated by its largest constituents during 2023. Looking at the annual performance of an equal weighted index of large stocks compared to a cap-weighted one shows that 2023 was the second worst year for the equal weight index going back to 1930! Beneath the surface of the broader indexes that look expensive or risky in other ways, we are still finding attractive investments by following the advice of the late great Charlie Munger to “fish where the fish are” and avoiding the over-fished spots.

2023 3Q Letter to Investors: Avoiding Risk

Lofty valuations among most of the so-called “Magnificent Seven” stocks place a heavy demand on future growth for those stocks as a group. If history is a guide, failure to achieve those implied growth rates could leave investors sorely disappointed. We see opportunities elsewhere, where free cash flow-based valuations do not look extended compared to historical levels.

Small Stocks, Big Debt Issues

Small stocks have big debt burdens and high borrowing costs and interest expense could rise further as debt is refinanced in the current, higher, interest rate environment. This incremental expense is likely to be a significant headwind for many small cap stocks in the coming years and is a key risk that our Small/Mid Quality Value strategy seeks to avoid.

2023 2Q Letter to Investors: Expensive at the Top

A strong rally moved market levels markedly higher in the second quarter, leaving any angst of the first quarter’s focus on banking turmoil behind. The rally, however, was driven mostly by handful of the biggest stocks that look increasingly rich relative to the market overall (see figure below). This dynamic has left our U.S. Fundamental Stability & Value (FSV) strategy lagging the S&P 500 Index by 5.3% YTD. Going forward, we believe it will be critical to navigate around rich valuations and avoid overpaying for enticing stories where substantial optimism is priced in and risk/reward profiles look resultingly more precarious.

Concentration Risk (2023)

The largest five stocks in the S&P 500 collectively have increased in value this year by $2.8 trillion, which is 49% above where they began the year. The level of concentration in the S&P 500 as measured by the over-24% total weight of just these five stocks is greater than it has ever been. Critically, this increase in value has resulted almost entirely from an enormous expansion in valuation rather than from improving fundamentals, and the group as a whole looks very expensive relative to the broader market.

2023 1Q Letter to Investors: Crosscurrents from Big Tech & Banks

Equity markets rose to start 2023 but experienced crosscurrents from very concentrated gains among a select few of the biggest stocks and weakness in the bank sector. In this environment, our U.S. Fundamental Stability & Value (US FSV) strategy lagged the S&P 500 while comfortably outpacing its value benchmark. Our Small/Mid Cap Quality & Value (SMID QV) and International FSV strategies outperformed their respective benchmarks in the period.

Distillate Reading List (2023)

Distillate Capital is built on a few core ideas gleaned from our decades of value investing experience and from the wealth of information and ideas emanating from the rigorous studies of accounting, behavioral finance, and risk management.

Year-End Letter to Investors: Value Mattered in 2022

Elevated inflation and rising rates are likely to cause economic activity to continue to moderate and even possibly contract, but from a longer-term perspective, this is not unusual and the economy and corporations have weathered much more difficult circumstances in the recent past. The legacy of anomalously low rates in the recent past has, however, fueled debt binges and stretched valuations that persist in parts of the market and look to be key risks to navigate around in capitalizing on the opportunities that recent negative sentiment have offered up.

2022 3Q Letter to Investors: Races Are Won In the Turns

The title of this letter is an auto racing adage that aptly applies to investing. It highlights that much more than in the straightaways, it is in the turns, both entering and coming out of them, where drivers differentiate themselves. In this regard, while we are pleased by the outperformance of domestic strategies in a difficult environment, we are much more encouraged by the relative positioning of all our strategies on our measures of quality and value.

2022 2Q Letter to Investors: YTD Sell-Off Drives Rotation

On measures of free cash flow, stocks have gotten notably less expensive in the first six months of 2022, and the first chart highlights the free cash flow yield now expected for both the U.S. FSV strategy and the S&P 500. While some of the market’s noted excesses have seen meaningful corrections year-to-date, selectivity remains critical in our view, and allows for meaningful differentiation versus benchmarks, whether considering valuation or measures of underlying quality.

Equity & Bond Valuations & Inflation

Amid an uncertain economic future, equities offer an attractive advantage of being able to pass through inflationary costs over the longer-term, but their present relative valuation against bonds does not seem to fully capture the benefit as it did historically. On top of this general opportunity in equities, we believe our equity investment methodology offers several further potential benefits, with a substantial valuation advantage over the market principle among them.

2022 1Q Letter to Investors: Differing Drivers of Returns

In the first quarter of 2022, each of Distillate’s strategies (U.S. FSV, Intl. FSV, and Small QV) outperformed their primary benchmarks. Crucially, performance both recently and over prior years has resulted from a very different driver of price gains compared to the market.

2021 Year-End Letter to Investors: Value Below the Surface

Distillate’s U.S. Fundamental Stability & Value (U.S. FSV) strategy outperformed its S&P 500 and iShares Russell 1000 Value ETF benchmarks again in 2021. For a further discussion of performance, portfolio changes, and why we continue to see value below the surface of a stock market that has gotten more expensive, please see our Year-End 2021 letter.

Concentration Risk

The largest 5 stocks in the S&P 500 Index accounted for 22% of its value at the end of last month vs. under 12% five years earlier. In this one-pager, we look at how rising relative valuations were the predominant driver of this shift.

2021 3Q Letter to Investors: Valuation & Quality Update

We review recent performance of Distillate’s U.S. Fundamental Stability & Value (FSV), International FSV and Small Cap Quality & Value strategies. Amid a backdrop of strong price gains and pockets of extremely rich valuations, we believe valuation is becoming an increasingly important risk to equity returns going forward, and we highlight the attractive free cash flow based valuation characteristics of our strategies as compared to their broad market benchmarks.

2021 2Q Letter to Investors: Valuation & Quality Update

In the wake of strong equity price gains across geographies and market caps, and amid pockets of very rich valuations, we review performance, portfolio changes, and how Distillate’s strategies compare to various benchmarks on measures of valuation and quality.

Asset Class Valuations in a Historical Context

Amid apprehensions about current valuations and their impact on prospective returns, we look at cash yields for various asset classes over time and relative to one another. In this framework, equities look somewhat expensive compared to historical ranges, but still appear relatively attractive in the context of other asset classes that are near historical extremes. The paper also examines the logic behind relative cash yields, the drivers of equity free cash flow growth over time, and potential reasons for the recent divergence in relative valuations.

2021 1Q Letter to Investors: What the Growth vs. Value Debate is Missing

In the U.S., 1Q21 brought a reversal in market leadership from the concentrated gains in “growth” stocks seen in 2020 to those commonly labeled “value.” After outperforming in an environment where traditional value lagged substantially, we were pleased to also generate excess returns in this recent period where growth stocks suffered. The U.S. FSV strategy continues to exhibit a relative performance pattern largely uncorrelated with traditional investment factors.

2020 Year-end Letter to Investors

Distillate’s U.S. and international strategies outperformed their respective benchmarks in 2020. In the U.S., substantial outperformance among the largest stocks presented a significant headwind and the resulting rich valuations are making the overall market look somewhat expensive. Fortunately, much of the risk from valuation appears concentrated in certain segments and our work suggests a meaningful portion of the markets, both in the U.S. and abroad, remain attractive.

2020 Q3 Letter to Investors: Why We Owned... and Sold Apple

In addition to strategy updates for our U.S. (US FSV) and International (INTL FSV) Fundamental Stability & Value strategies, we look at the evolution Apple Inc. (AAPL) from one of the least expensive stocks in the market at various times over the last decade to one with a premium valuation today.

2020 Q2 Letter to Investors & Introduction of the International Fundamental Stability & Value Strategy

We introduce our International Fundamental Stability and Value strategy (Intl. FSV) and discuss performance and portfolio changes in the U.S. FSV portfolio related to the attractive opportunity set we are seeing within an increasingly bifurcated market.

A Lopsided Crisis

The economic impacts of the coronavirus crisis are extremely uneven. Estimates of free cash flow for stocks in hard-hit industries are down 90%. The free cash flow estimates for the remainder of the market have held nearly steady, down just 5% over the same period. The concentrated fundamental weakness, however, is at odds with much broader stock price weakness that has been masked by enormous strength at the top of the market. We see significant opportunity in this mismatch.

2020 Q1 Letter to Investors: The Corona-Crisis and Prospects for Recovery

In addition to providing updates on strategy performance and portfolio changes, we look at the current economic crisis brought on by the outbreak of COVID-19 as well as the possible innovation-driven path to recovery. We see our investment process particularly well suited for this environment, with its focus on inexpensive stocks of financially healthy companies that can endure this challenging near-term environment.

March 2020: Interim Update to Investors

While market prices, in theory, should reflect the discounted value of a very long stream of future cash flows, they are prone to panic and often overreact to near-term disruptions. The current environment, brought on by worries of the spreading COVID-19 disease, seems like exactly such an instance. While we do not attempt to predict stock market performance, this letter provides an update on recent performance, portfolio characteristics and equity valuations.

Value Failed Because It Was Expensive

So-called “value” indexes have severely underperformed the broader stock market for more than a decade. While this is an often-told story, it typically comes without any compelling explanation of why these indexes of purportedly inexpensive stocks continue to disappoint. In this 2 page note, we examine definitional issues with common value indexes and conclude that “value” underperformed because it didn’t in fact represent a better value than the market overall. It was, in a word, expensive!

2019 Year-end Letter to Investors: The Market Rally in a Long-Term Context

We provide an update of our U.S. Fundamental Stability & Value strategy’s performance, portfolio changes, and fundamental attributes. We also discuss the equity market’s recent performance in a longer-term historical context, noting that the time period chosen for evaluation can lead to starkly different conclusions.

Regional Equity Performance & Valuation

The U.S stock market has significantly outpaced major international indexes over the past decade. In this short paper, we look at the drivers behind this by splitting price gains into fundamental and valuation components. We find that despite frequent commentary to the contrary, a majority of the appreciation in U.S. stocks can be explained by increased free cash flow and not higher valuation multiples. We also note a convergence in regional free cash flow yields over time such that the relative attractiveness between regions at present rests more on other factors, like stability & growth, where the U.S. continues to compare favorably.

2019 Q3 Letter to Investors: Long-Term Equity Valuations & Looking Past “Factor” Noise

We provide an update of strategy performance and portfolio positioning. We also look at equity market valuations in a historical context, relative to both underlying fundamentals and the valuations of other asset classes. Finally, we touch on “factor” investing and discuss valuation risks we see among popular Low Volatility strategies, as well as definitional problems with traditional labels like Quality and Value.

Value Investing in a Capital-Light World

The composition of the economy and stock market has shifted from physical assets to intellectual ones. This change has significant implications for traditional valuation metrics, requiring a new approach.

2019 Q2 Letter to Investors: The Lurking Risk of Elevated Debt Levels

We provide an update of strategy performance and the market environment, discuss the dangers of elevated debt levels, and describe the unintended risks investors might be taking as they seek safety in certain stocks with with low price volatility but increasing levels of debt.

2019 Q1 Letter to Investors: Mismeasuring “Value” and the Risks in Low Beta Stocks

We provide an update of strategy performance so far in 2019, portfolio changes and positioning, as well as our thoughts on the mismeasurement of “Value” as it is commonly discussed and what we believe to be underappreciated risks embedded in low beta stocks.

Buffett Abandons Book Value

We relate Warren Buffett’s recent comments on book value to our own investment process and make the case that investors buying a “value” index might, unintentionally, simply be taking on exposure to asset-intensive sectors rather than truly under-priced securities.

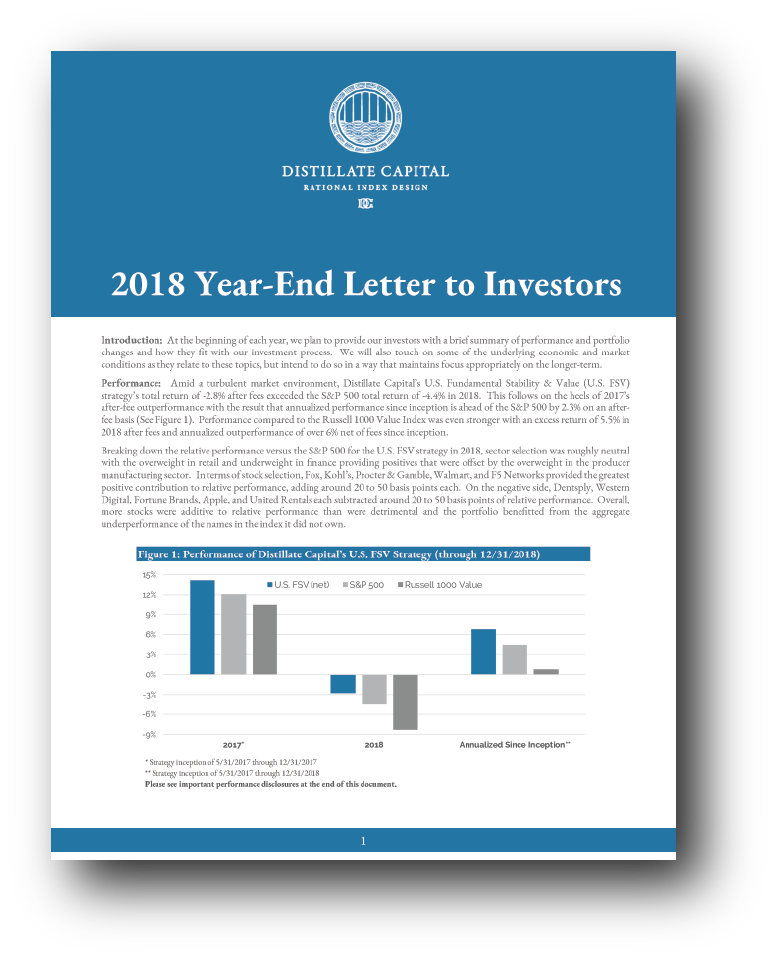

2018 Year-End Letter to Investors

Our annual review of performance, recent changes to our portfolio, and comments on the outlook for equities in the years ahead.

Long-Term Investing: The Costs of Myopic Thinking

Adhering to long investment time horizons is easily said but more difficult to do. Emotions and behavioral biases work to erode the otherwise attractive returns offered by equity markets when evaluated over multi-year periods. Properly framing comparisons between equities and other assets—like bonds—can help investors avoid the risk of falling short of return objectives.

FAANG Valuations: A Mismatch of Old Metrics and New Companies

The group of stocks known as the FAANGs (Facebook, Apple, Amazon, Netflix, and Alphabet) have garnered significant attention from investors and market pundits—often painted as a homogeneous, overvalued set of stocks. However, we see the FAANGs providing a good example of the shortcomings of traditional valuation metrics. Using our distilled cash yield methodology, a more nuanced view of FAANG valuation emerges.

Risk: Fundamentals Over Price Volatility

Investors should consider investment risk as defined by an investment’s fundamental stability, level of indebtedness, and valuation, rather than simply its short-term price volatility.

Behavioral Biases: Exploiting Systematic Mispricings

Deeply rooted behavioral biases can offer exploitable opportunities for a thoughtfully designed, systematic investment approach.