SURVIVE the crisis, THRIVE in the recovery?

Distillate U.S. Fundamental Stability & Value ETF (DSTL):

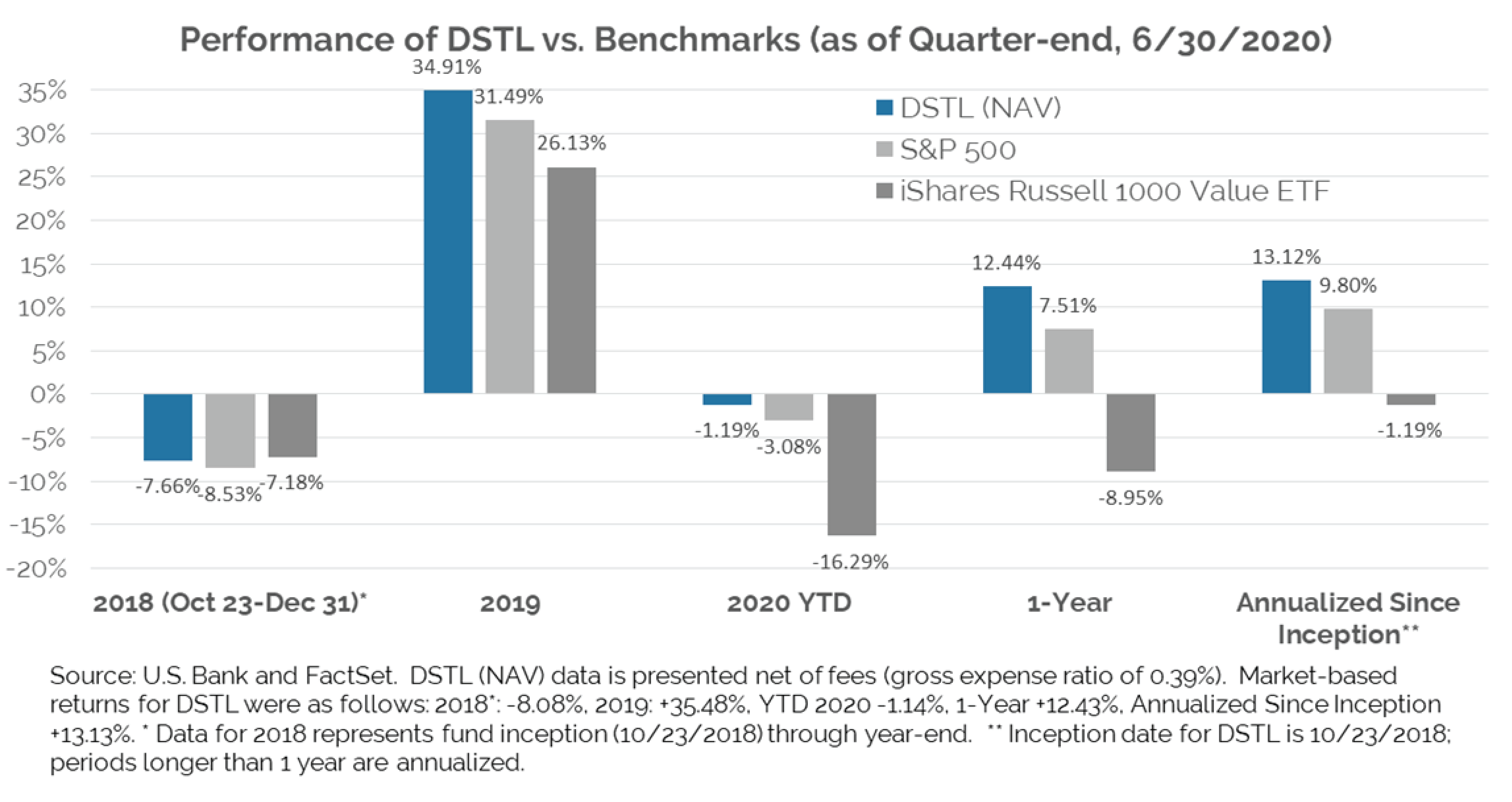

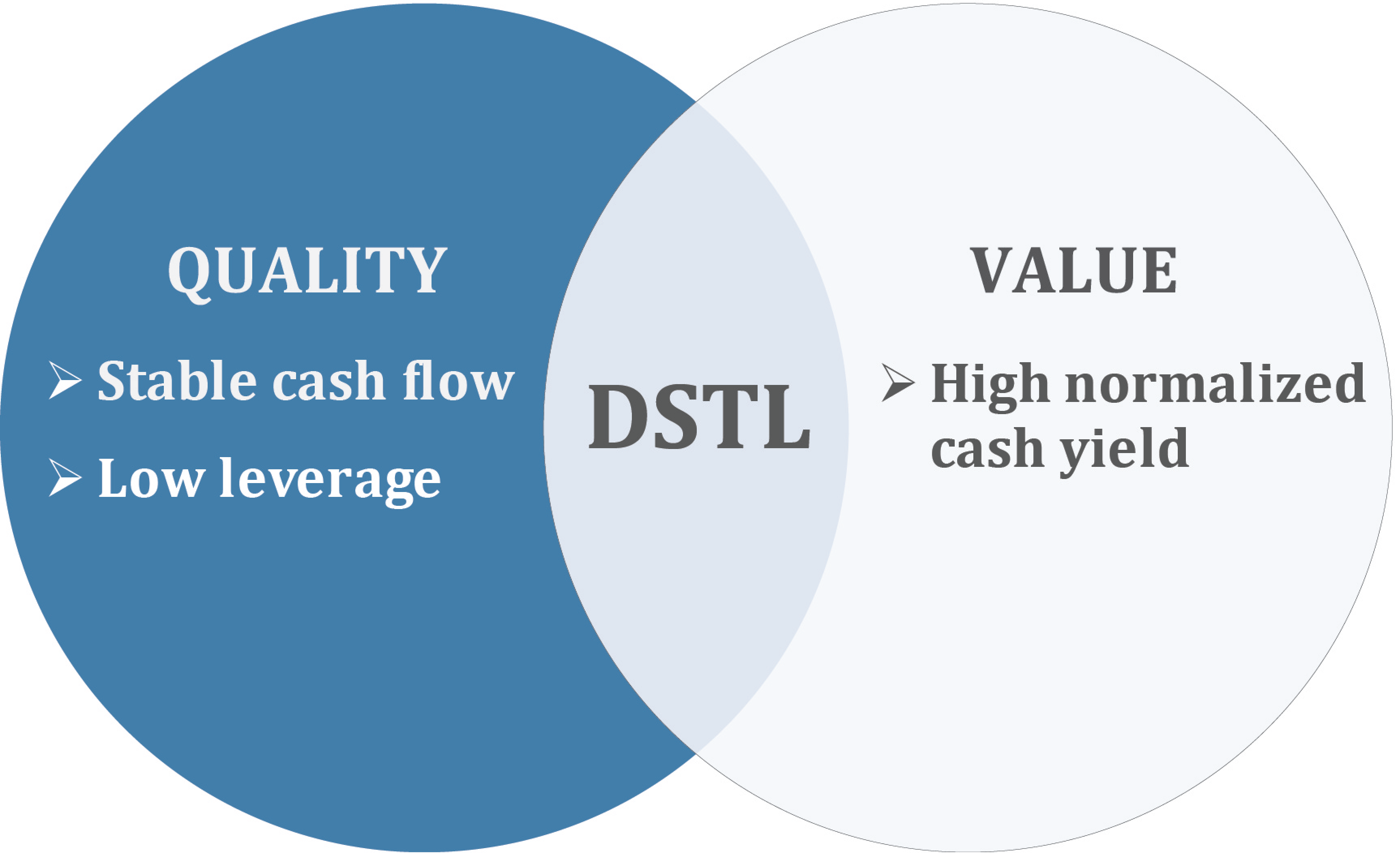

- DSTL is a large-cap U.S. ETF that distills the broader market into the most attractive 100 stocks based on cash flow stability, low leverage, and normalized free cash flow to enterprise value ratio.

- DSTL has outperformed in both up and down markets by using customized measures of quality and value designed to work in an asset-light economy where many traditional measures have struggled.

The performance data quoted represents past performance. Past performance does not guarantee future results. The investment return and principle value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than their original cost and current performance may be lower or higher than the performance quoted. Performance current to the most recent month-end can be obtained by calling 1-800-617-0004.

The performance data quoted represents past performance. Past performance does not guarantee future results. The investment return and principle value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than their original cost and current performance may be lower or higher than the performance quoted. Performance current to the most recent month-end can be obtained by calling 1-800-617-0004.

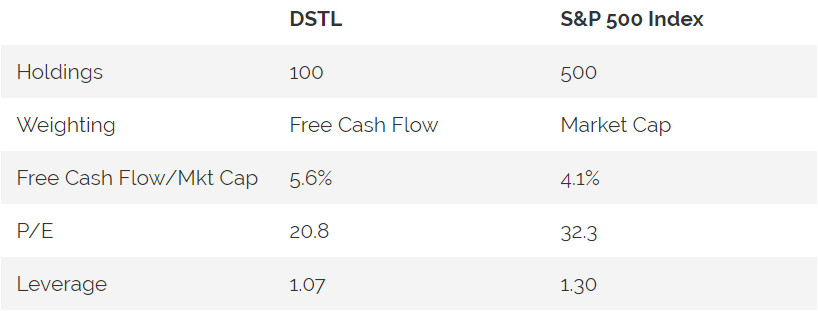

- The current portfolio is more attractively valued than the market on a free cash flow basis, and has less leverage (see table below) —attributes we believe make it well suited both in this crisis and the long-term.

Source: FactSet; Data as of 7/8/2020. See end notes for definitions.

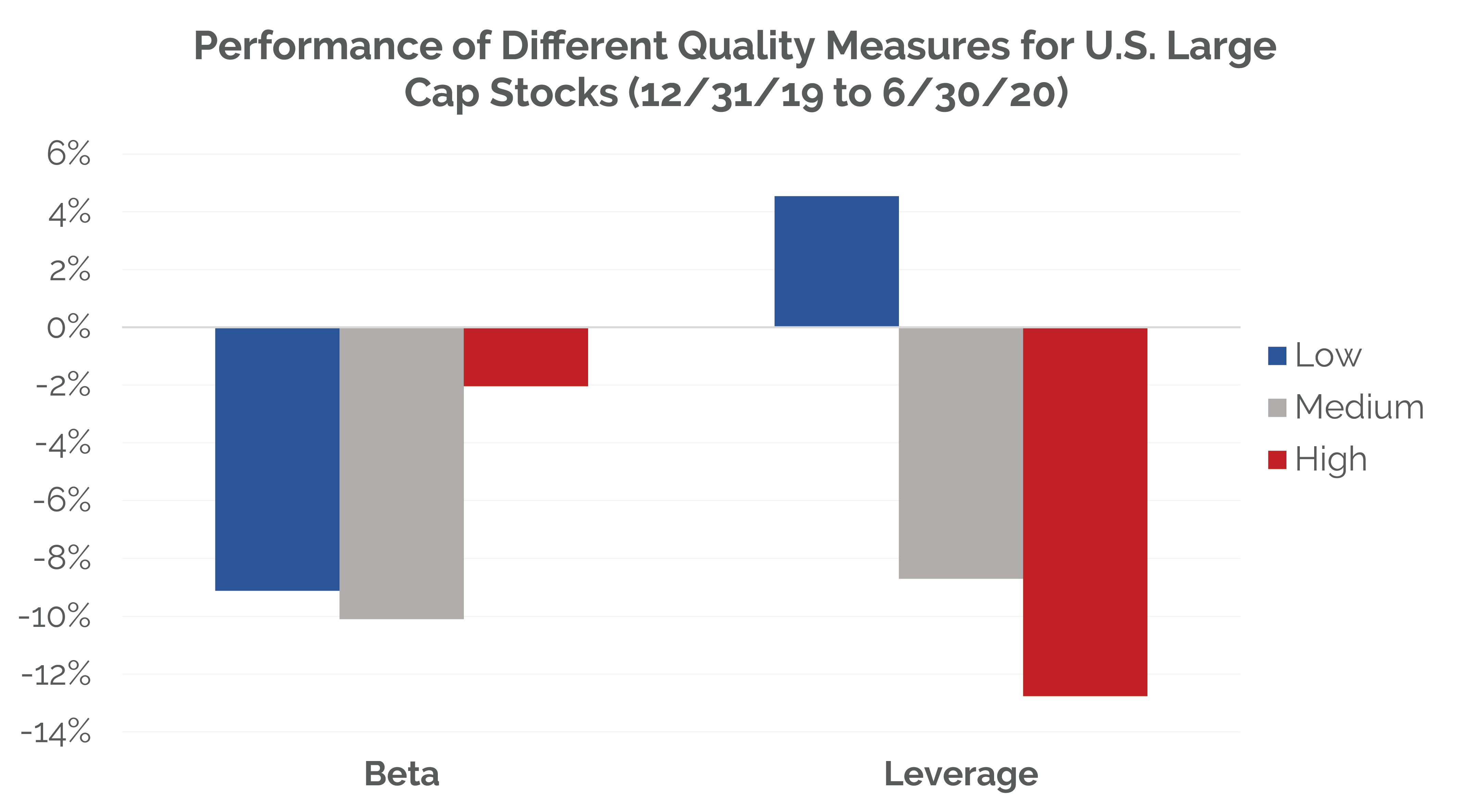

Focus on Quality:

- Price volatility (Beta focus) can change suddenly in times of crises so we focus instead on metrics like balance sheet strength to measure quality and attempt to limit downside potential in volatile markets.

- This measure of quality did much better in differentiating performance in the recent crisis than stock price volatility where low and medium beta stocks did worse on average than high beta stocks.

See end-notes for details on methodology. Past performance does not guarantee future results.

See end-notes for details on methodology. Past performance does not guarantee future results.

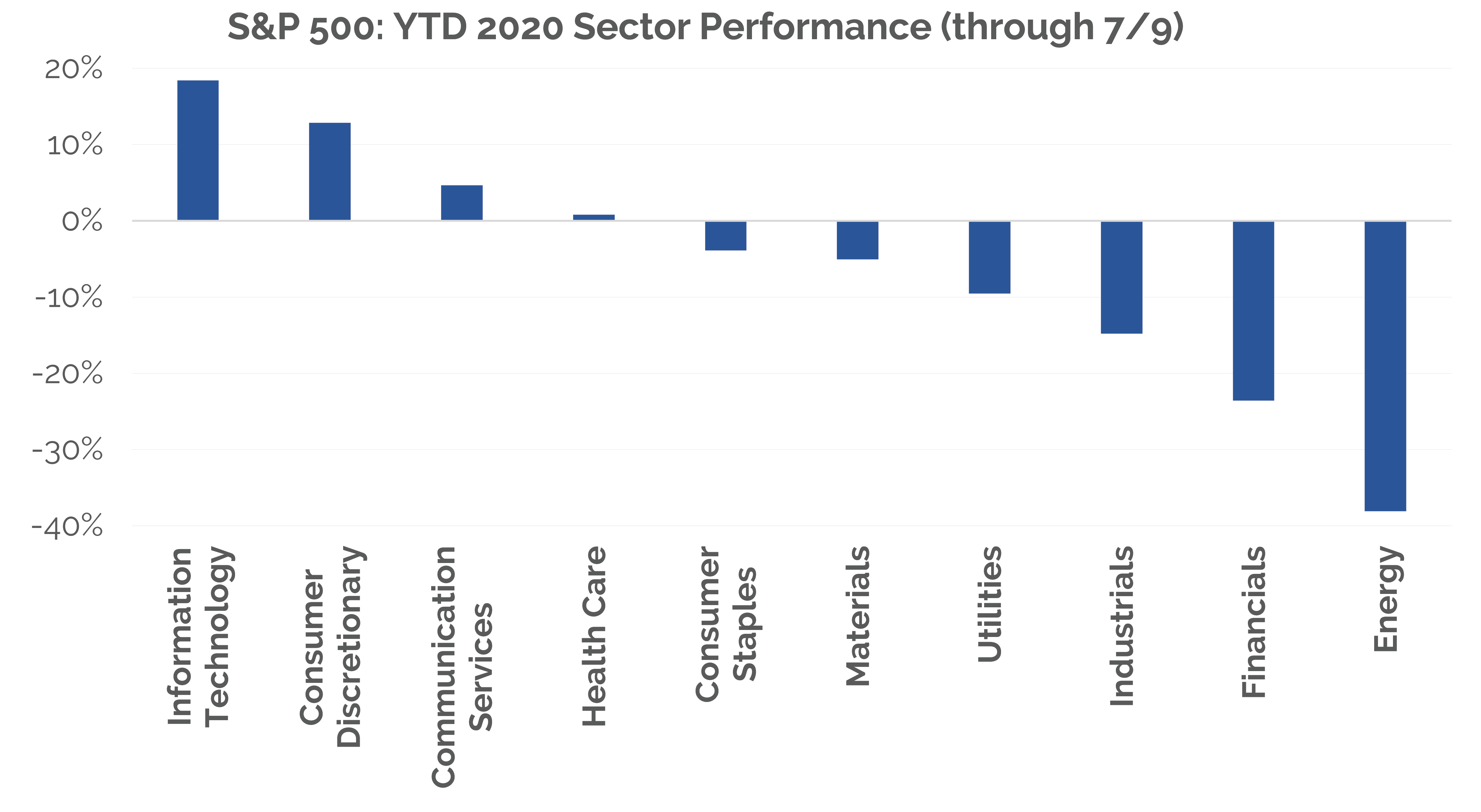

- From a sector/industry vantage, this methodology has led to low exposure to sectors that suffer longer-term structural challenges such as airlines, energy, real estate, & banks. It has also led to high exposure to tech, healthcare, communications, and consumer sectors which have benefited from favorable long-term secular trends and potential post-virus recovery.

Source: FactSet. Past performance does not guarantee future results.

Focus on Value:

- As intangible assets became key drivers of profitability, accounting-based valuation metrics that focus largely on tangible assets have lost relevance and efficacy. To avoid this distortion, DSTL uses a free cash flow-based methodology that makes systematic accounting adjustments to restore comparability across companies.

- DSTL’s use of a unique normalized measure of free cash flow that reflects a company’s long-term profit-generating capacity also may avoid situations like the present when near-term estimates are less helpful.

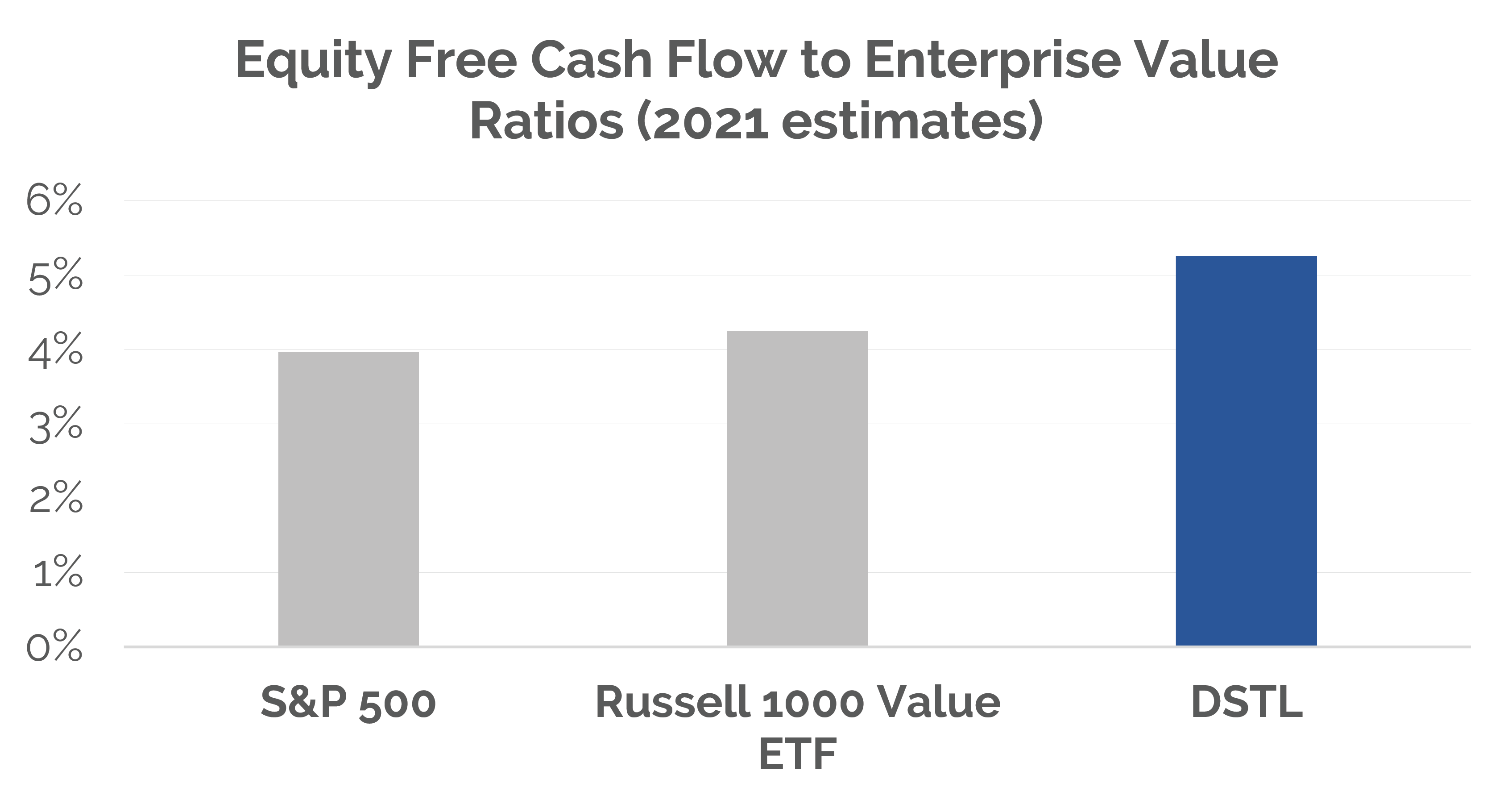

- Even after the market rebound (driven by the largest stocks), we see significant valuation opportunities going forward. On the basis of 2021-estimated free cash flows to enterprise value, DSTL is more attractively valued than the S&P 500 and the constituents of the iShares Russell 1000 Value ETF (see chart below).

Source: FactSet

Survive & Thrive:

- In the current crisis, we believe DSTL’s approach is well suited, identifying stocks with strong balance sheets and stable fundamentals that can SURVIVE the challenging near-term, while still capturing valuation opportunities to potentially THRIVE in the recovery.

The Funds’ investment objectives, risks, charges, and expenses must be considered carefully before investing. The statutory and summary prospectus contain this and other important information about the investment company and may be obtained by calling 800-617-0004 or by visiting www.distillatefunds.com. Please read it carefully before investing.

Investing involves risk. Principal loss is possible. To the extent the Fund invests more heavily in particular sectors of the economy, its performance will be especially sensitive to developments that significantly affect those sectors. As a passively managed ETF, the Fund does not attempt to outperform its Index or take defensive positions in declining markets. As an ETF, the fund may trade at a premium or discount to NAV. Shares of any ETF are bought and sold at market price (not NAV) and are not individually redeemed from the Fund. Brokerage commissions will reduce returns. The Distillate Fundamental Stability & Value Index tracks the performance of 100 large U.S. stocks that meet Distillate’s proprietary stock selection criteria. The Index is calculated by Solactive AG. It is not possible to invest directly in an index.

DSTL is distributed by Quasar Distributors, LLC.

This material is provided for informational purposes only and is not intended as an offer or solicitation for the sale of any financial product or service or as a recommendation or determination by DCP that any investment strategy is suitable for a specific investor. Investors should seek financial advice regarding the suitability of any investment strategy based on their objectives, financial situations, and particular needs. The investment strategies discussed herein may not be suitable for every investor. This material is not designed or intended to provide legal, investment, or other professional advice since such advice always requires consideration of individual circumstances. If legal, investment, or other professional assistance is needed, the services of an attorney or other professional should be sought. The opinions, estimates, and projections presented herein constitute the informed judgments of DCP and are subject to change without notice. Any forecasts are subject to a number of assumptions and actual events or results may differ from underlying estimates or assumptions, which are subject to various risks and uncertainties. No assurance can be given as to actual future results or the results of DCP’s investment strategies.

Portfolio holdings and sector allocations are subject to change at any time and should not be considered recommendations to buy or sell any security. References to other mutual funds should not to be considered an offer to buy or sell these securities.

The information in this presentation has been obtained or derived from sources believed to be reliable, but no representation is made as to its accuracy or completeness.

Cash Flow refers to operating cash flow, or the amount of cash generated by business operations, not considering investments in such things as property & equipment or changes in cash due to financing activities.

Free Cash Flow refers to the cash generated by a business after accounting for capital investments required to maintain or grow the business.

Free Cash Flow to Market Cap is based on the next-twelve-month free cash flow estimate divided by market capitalization. Stocks without estimates in the index are excluded and the remaining names are reweighted based on those exclusions.

P/E refers to the price-to-earnings ratio and is based on the current share price divided by consensus-estimated earnings-per-share over the next twelve months as of June 15th, 2020. Figures over 250 and under 0 are excluded to avoid distortions.

Leverage is based on Distillate Capital’s proprietary measure of indebtedness which looks at the ratio of adjusted net debt to an adjusted measure of forecast Earnings Before Interest, Taxation, Depreciation, and Amortization (EBITDA.)

Beta refers to a measure of stock price variability relative to the underlying index, in this case the S&P 500, and is calculated using FactSet data over the prior 3-year period.

Enterprise value refers to a stock’s market capitalization plus net debt.

Normalized free cash flow to enterprise value ratio refers to Distillate’s proprietary estimate of future free cash flow, divided by Distillate’s proprietary measure of a company’s enterprise value.

Methodology for Chart titled “Performance of Different Quality Measures for U.S. Large Cap Stocks (12/31/19 to 6/30/20)”: The stock universe for the figure is the Solactive U.S. Large Cap Index. Beta refers to a measure of stock price variability relative to the underlying index, in this case the S&P 500, and is calculated using FactSet data over the prior 3-year period. Leverage is based on Distillate Capital’s proprietary measure of indebtedness which looks at the ratio of adjusted net debt to an adjusted measure of forecast Earnings Before Interest, Taxation, Depreciation, and Amortization (EBITDA). For each grouping, stocks without data were excluded and the remainder were sorted into thirds labeled low, medium, and high. In 2020 through June 30, the low beta group underperformed the high beta group, indicating that beta, on its own and as measured in the description above, was not a meaningful differentiator of performance during this period. Stocks with low leverage, as measured above, outperformed high leverage stocks, indicating that this measure of quality saw more differentiation in stock returns over the aforementioned time period.

The S&P 500 Index is an index of roughly the largest 500 U.S. listed stocks maintained by Standard & Poor’s.

For purposes of comparison, the iShares Russell 1000 Value ETF is used as a proxy for its underlying index, the Russell 1000 Value Index, which is a stock index managed by FTSE Russell representing mid- and large-capitalization U.S.-listed stocks that appear inexpensive on FTSE Russell’s valuation criteria. The iShares Russell 1000 Value ETF aims to track this underlying index and carries an expense ratio of 0.19%. DSTL tracks the Distillate U.S. Fundamental Stability & Value Index, an index of roughly 100 large-capitalization stocks that exhibit attractive quality and valuation characteristics based on Distillate Capital’s proprietary measures. DSTL carries an expense ratio of 0.39%. Comparing the risks of these ETFs, DSTL might be expected to underperform broad market indexes when stocks with low market prices relative to their cash flow underperform; whereas the iShares Russell 1000 Value ETF might be expected to underperform when stocks with low market prices relative to their book value underperform.

Indices are not available for direct investment. Investment in a security or strategy designed to replicate the performance of an index will incur expenses, such as management fees and transaction costs, which would reduce returns.

© Copyright 2020 Distillate Capital Partners LLC